Table of Contents

Available with Team Administrators

You want to store a tax ID in SeaTable? No problem, via the team administration this is possible in just a few steps at any time.

Deposit of the tax ID

Depositing the tax ID is possible both when booking a subscription and subsequently.

- Open the Team administration.

- Switch to the Subscription section.

- Click on “Customize billing information”.

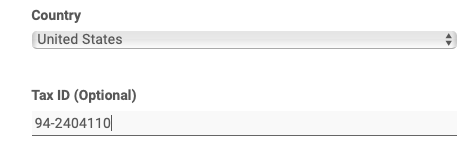

- Deposit a tax ID in the field provided.

- Save the change with Change invoice recipient.

Automatic check of the tax ID

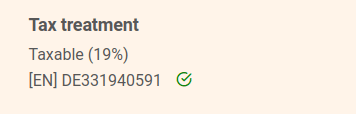

After submitting the form, your tax ID will be automatically checked and compared against the address you provided. The check may take several minutes.

Only when the verification has been successful, the tax ID will be effective and used on future invoices. Also, the preview of the future invoice amount will not be adjusted until the tax ID has been verified as valid.

Frequently asked questions about the tax ID

Is the tax ID printed on the invoice?

My tax ID is not accepted?

What is the significance of the tax ID for VAT?